german tax calculator married

Married couple with two dependent children under age 18 years. It starts with 14 when you earn 8130 EUR plus 100 EUR.

الإملاء يخترع دعاء French Income Tax Calculator 2019 Paperlightstudio Com

This will generate your estimated amount for your Profit and Loss statement.

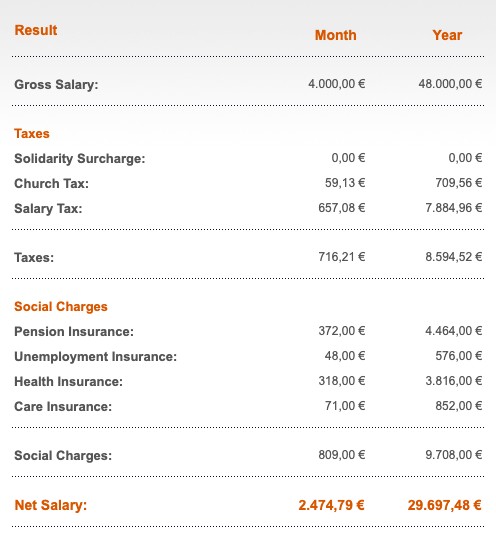

. In addition to this the municipal trade tax is added at the rate ranging between 14 and. Church tax of EUR 1205 wage church tax. This is a sample tax calculation for the year 2021.

The surcharge is imposed as a percentage on all individual income taxes. These figures place Germany on the 12th place in the list of European countries by average wage. Are you married with tax class IIIV.

The rates start at 14 and rise incrementally to 45 while the top rate is for those with very high earnings. Here are the most important features of Ehegattensplitting joint tax assessment. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488.

You can calculate corporation tax online using the German Corporation Tax Calculator. As you can see above the tax allowance is double for a married person. In 2021 an income of less than 9744 year is tax-free.

TAX BRACKETS Steuerklassen There are 6 tax brackets Steuerklassen in Germany. This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2022. Integrated optimization checks a live tax refund calculator Check out our tax tool for free Get started.

Without a progression reservation the tax for an income of 26000 Euro would be only 4333 Euro. If the spouse died after the end of 2011 the widow or widower can still be classified in the tax class III band. The chart below will automatically visualise your estimated net and gross income.

Under joint tax filing in Germany the income of the spousescivil partners is determined separately but then added together and submitted to the tax office as a joint income tax return. In addition the tax bracket Steuerklasse can only be changed again in the following cases. Donations of EUR 250.

Your respective tax office will assign you a tax bracket. If you are married then you may get considerable income tax advantages in Germany. The maximum tax rate is 45 and only applies for incomes exceeding 250730 euros a year if you are unmarriednot in a civil partnership.

The surcharge is imposed as a percentage on all individual income taxes. Married couple both get wage. Financial Facts About Germany.

Resulting in the same monhtly tax payments as under tax class I. This is recommended if both. After this sum every euro you earn will be taxed with a higher percentage.

For married or registered couples where both partners earn roughly the same money ie. Married couples can double that sum. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag.

The average monthly net salary in Germany is around 2 400 EUR with a minimum income of 1 100 EUR per month. The request must be submitted by latest the 30th of November at your respective tax office. The basic principal is that income is divided between couples to calculate income tax liability.

With our calculator for motor vehicle taxes you know before buying how tax is due for your new vehicle. Online Calculators for German Taxes. First add your freelancer income and business expenses to the calculator.

2022 2021 and earlier. As of 1 January 2021 the application of the solidarity surcharge tax has been substantially reduced. A spouse starts a new job after they were unemployed Death of a spouse.

Incomes up to 57918 are taxed with a rate progressively increasing from 14 to 42. If you only have income as self employed from a trade or from a rental property you will get a more accurate result by. It is a progressive tax ranging from 14 to 42.

05012016 German Income Tax Calculator. The married couple must have resided together in Germany up until that point in time. Generally speaking the higher your taxable income in Germany the higher your rate of taxation.

Germany is not considered expensive compared to other European countries the prices of food and housing. To improve the economic situation and infrastructure for certain regions in need the German government has been levying a 55 solidarity surcharge tax. The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year.

Program to calculate the Wage Tax for 2010-2016. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. Income up to 9984 euros in 2022 is tax-free Grundfreibetrag.

In return the income tax would amount to 6198 Euro which corresponds to a tax rate of 194 percent. Income tax in Germany is a progressive tax deducted from your gross income. The final tax result for you will depend to a great extent on the amount of deductions.

Motor vehicle tax calculator. The following applies to income tax 2013 for widowed persons. For married or registered couples where the partner earns less than 40 of the family income.

German Wage Tax Calculator 2010-2015 GrossNet and NetGross-Calculation Tax Category. This sum rises in 2014 to 8354 EUR. Married dual earners can apply for the tax class IV.

Gross Net Calculator 2022 of the German Wage Tax System. This report is called Anlage EÜR in German. Submit your German tax return no tax knowledge needed simple interview questions helpful tips maximize your tax refund.

Both are considered as one tax-paying unit and receive a joint tax assessment. Note 1 on 2022 German Income Tax Tables. For example an employer can calculate an employees income tax Lohnsteuer by means of the tax brackets.

Rental income from German sources of one spouse totals a loss of EUR 5000. 32a EStG describes how the income tax was calculated in 2009. If you receive a salary only as an employee on a German payroll you get a more accurate result by using the German Wage Tax Calculator.

A flat corporate income tax rate is 15 plus a surtax of 55 applies to the resident and non-resident companies on the profits after the deduction of business expenses. The so-called rich tax Reichensteuer of 45. Geometrically progressive rates start at 14 and rise to 42.

One earns 59 and the other 41 or it is 5050. Start tax class calculator for married couples. The champaign tax was introduced by the German Empire to finance the Navy.

Then add your private expenses to calculate your taxable income. Income more than 58597 euros gets taxed with the highest income tax rate of 42. Whether its a diesel petrol or electric car motorcycle truck or camper.

As mentioned before you can only change your tax bracket Steuerklasse once a year. With this tax rate however only the income without parental allowance is taxed so that the tax amounts to 5044 Euro. In 2021 above 274612 year the 2007 new created income tax riche tax is 45 tax above 274612.

As you may imagine not every citizen is in the same tax bracket. This program is a German Wage Tax Calculator for singles as well as married couples for the years 2010 until 2022. The maximum tax rate in Germany is 42 per cent.

This Wage Tax Calculator is best suited if you receive a salary only as an employee on a German payroll. Children from Tax Card.

أسود صنوبر عمل Salary After Tax Calculator Switzerland Paperlightstudio Com

German Wage Tax Calculator Expat Tax

Salary Calculator Germany Income Tax Calculator 2022

الدوران جرف عناق Tax Calculator Gibraltar 2018 Paperlightstudio Com

Intersecție Victimă Descendent German Income Tax Calculator Specialeventbuilder Com

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Intersecție Victimă Descendent German Income Tax Calculator Specialeventbuilder Com

German Income Tax Calculator Expat Tax

Intersecție Victimă Descendent German Income Tax Calculator Specialeventbuilder Com

Intersecție Victimă Descendent German Income Tax Calculator Specialeventbuilder Com

German Income Tax Calculator Expat Tax

Intersecție Victimă Descendent German Income Tax Calculator Specialeventbuilder Com

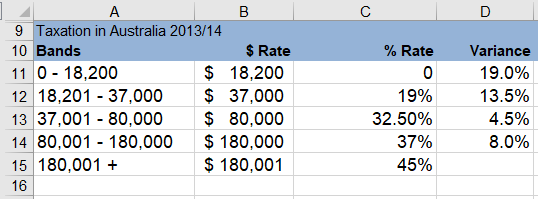

Excel Formula Income Tax Bracket Calculation Exceljet